Financial equity tracker for 10,000+ employees of the Philippines’ largest university network

UP Provident Fund (UPPF) is a voluntary retirement savings program established by the University of the Philippines (UP) for the benefit of its employees. Through the UPPF, UP employees are empowered to proactively invest in their future by contributing a portion of their earnings towards their retirement savings. This program provides a structured platform for employees to accumulate funds over the course of their careers, with the aim of securing a comfortable and financially independent retirement.

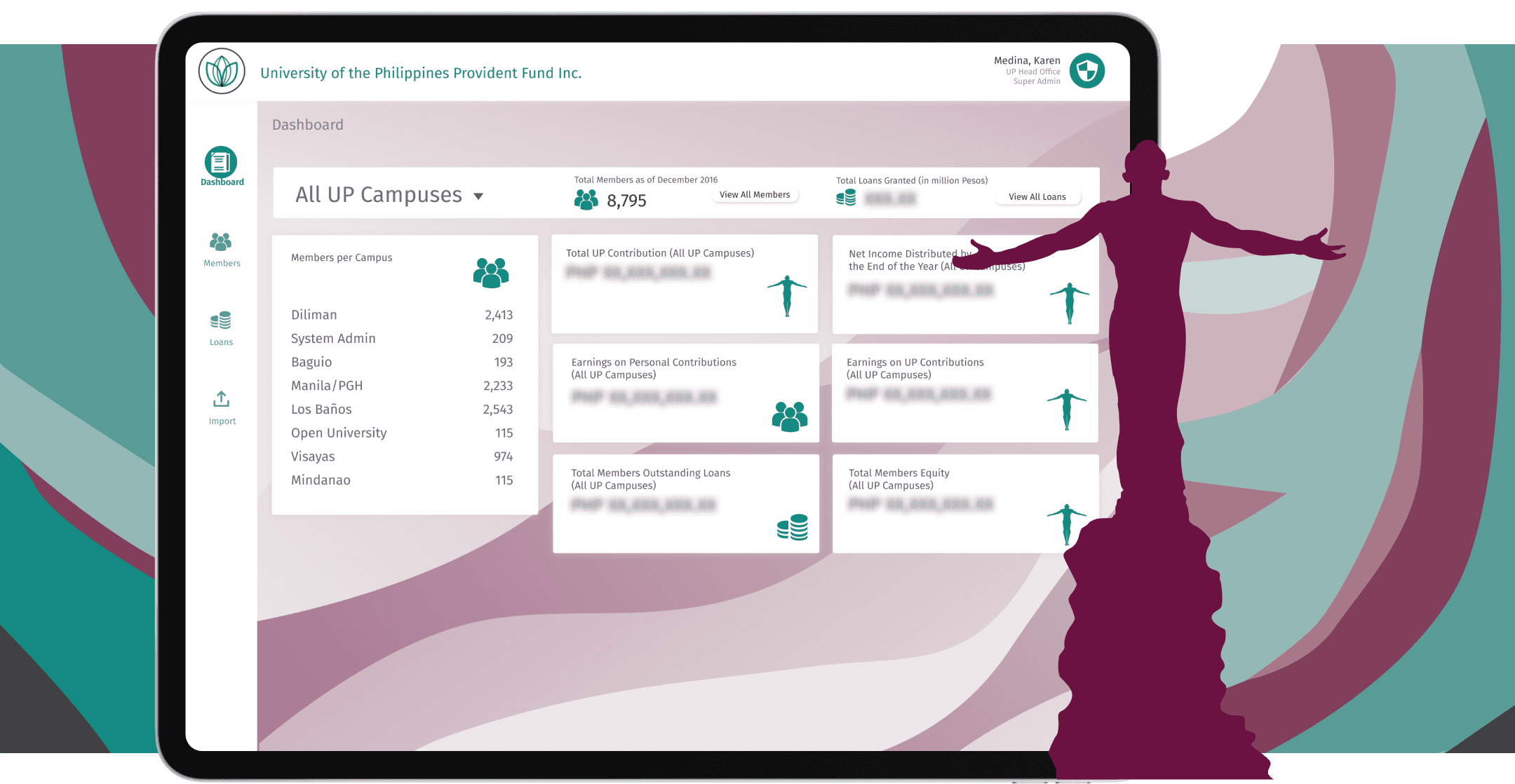

A Portal for All

To streamline and enhance the accessibility of services for its members, the UP Provident Fund Incorporated (UPPFI) can develop a comprehensive online portal that offers a user-friendly interface for members to conveniently check the status of their contributions, loans, and equity. Here's an outline of the features and functionalities that the portal could include: Member Dashboard Upon logging in, members are greeted with a personalized dashboard displaying an overview of their account, including current contribution balance, outstanding loans, and equity status. Contribution Status Members can view a detailed breakdown of their contribution history, including monthly contributions, total accumulated balance, and any additional voluntary deposits made. They can also track any changes or updates to their contribution rates. Loan Management The portal allows members to monitor the status of their loan applications, view outstanding loan balances, repayment schedules, and any accrued interest. Members can also access loan calculators to estimate loan amounts, terms, and monthly repayments. Equity Information Members can access information regarding their equity shares in the UPPFI, including the current value of their shares, dividends received, and any changes in equity allocation.

Varying Admin Views

The UP Provident Fund Incorporated (UPPFI) has an administrative system with different access levels for accountants:

Superadmin

This person has full control over the entire system, seeing and managing everything across all campuses and clusters.

Cluster Accountants

They manage finances for specific clusters of campuses. They can only access data related to their assigned clusters. All accountants can generate reports and analyze financial data to make informed decisions. The system also has security measures to keep data safe. This setup ensures efficient management and accountability throughout the UPPFI.

Boosting Growth

In the four years since its launch, the UP Provident Fund (UPPF) has seen impressive growth. Its membership has expanded to 10,000, and its assets have soared from Php 1 billion to Php 3.2 billion. This growth has been fueled by the user-friendly member portal, which has made it easier for members to check their contributions and manage their loans. This portal has enhanced member satisfaction and trust in the UPPF, demonstrating its commitment to providing accessible and efficient services to its growing membership.