Case Study

B2B fintech SaaS for one of the country’s biggest conglomerates

Last Updated on October 7, 2025

by White Widget Team

Want to create fintech solutions that count? Let's add value and subtract limitations.

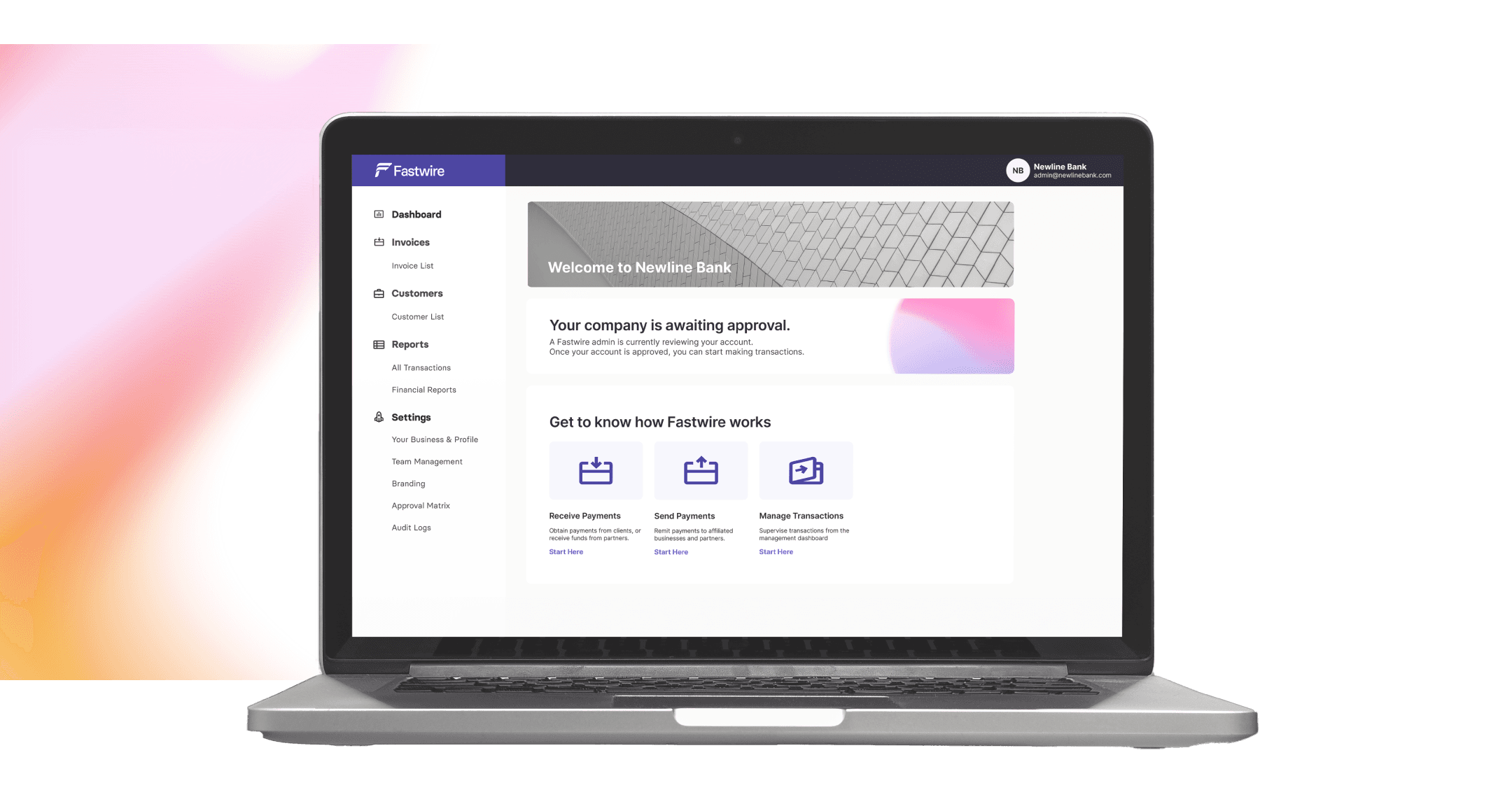

Fastwire is a comprehensive platform designed to streamline financial operations for businesses. It allows finance teams to easily generate invoices, schedule collections, and track transactions. With Fastwire, businesses can also access financial reports to gain insights into their financial performance. One of the key features of Fastwire is its integration with external payment providers. This allows customers to make payments directly through the platform, making the process more efficient and convenient. In addition, Fastwire includes a powerful admin interface that allows administrators to supervise the accounting and activities of businesses across the platform. This feature makes it easy for administrators to keep track of financial data, identify trends, and make informed decisions. Overall, Fastwire is an innovative solution that simplifies financial operations and helps businesses to achieve their financial goals.

Strategic Partnership

Entire Platform

Product Design

UX Research

Custom Development

Web App for Admins

End-Users and Partners

Cybersecurity

DevOps

While there’s certainly competition in the consumer fintech space, forward-thinking group Filinvest, represented by their startup arm f(dev), sought to embrace B2B payment fulfilment. They partnered with White Widget to build the best-in-class modern payments fulfilment platform for enterprise companies. Instead of launching publicly outright, it was designed so that their internal businesses would be the first to utilise the solution, so they were their own first customer. This was a feat that only a company like theirs, with its portfolio of holdings across multiple industries, could muster.

Payments Innovation

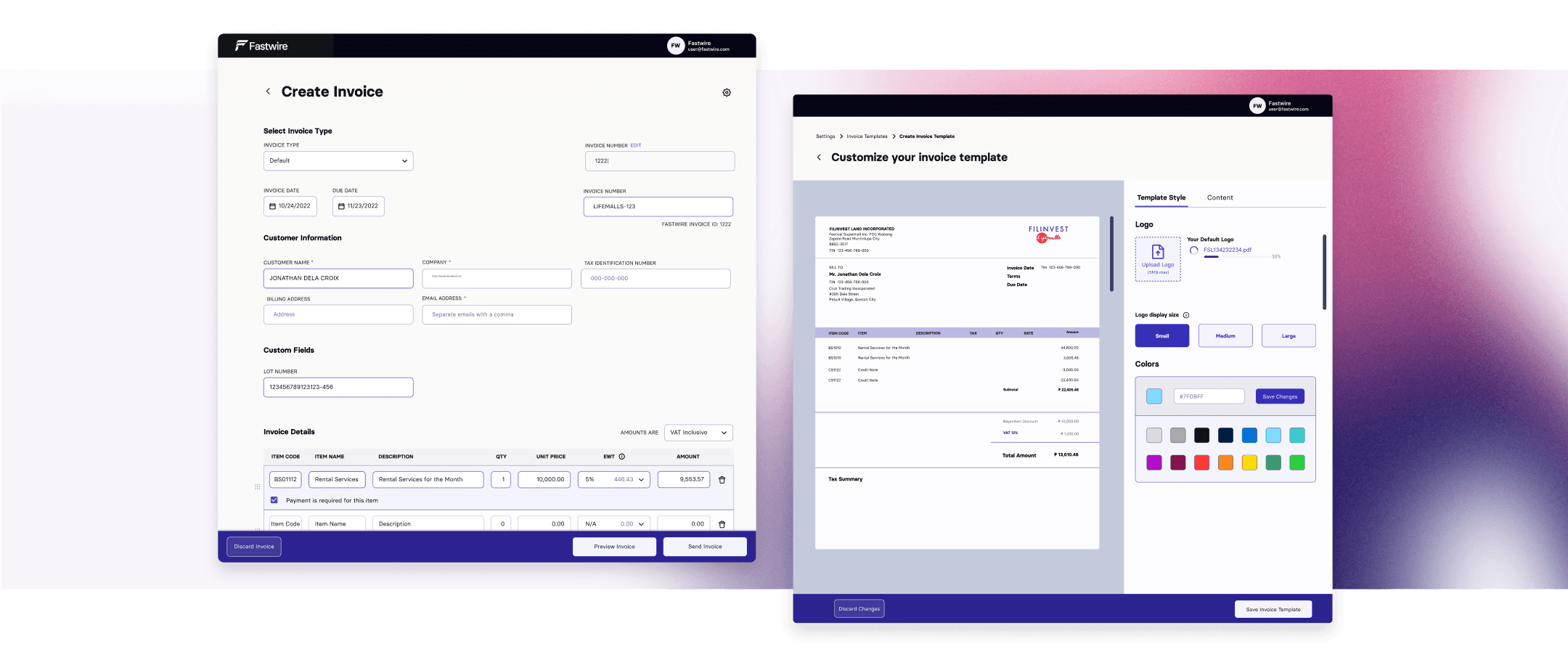

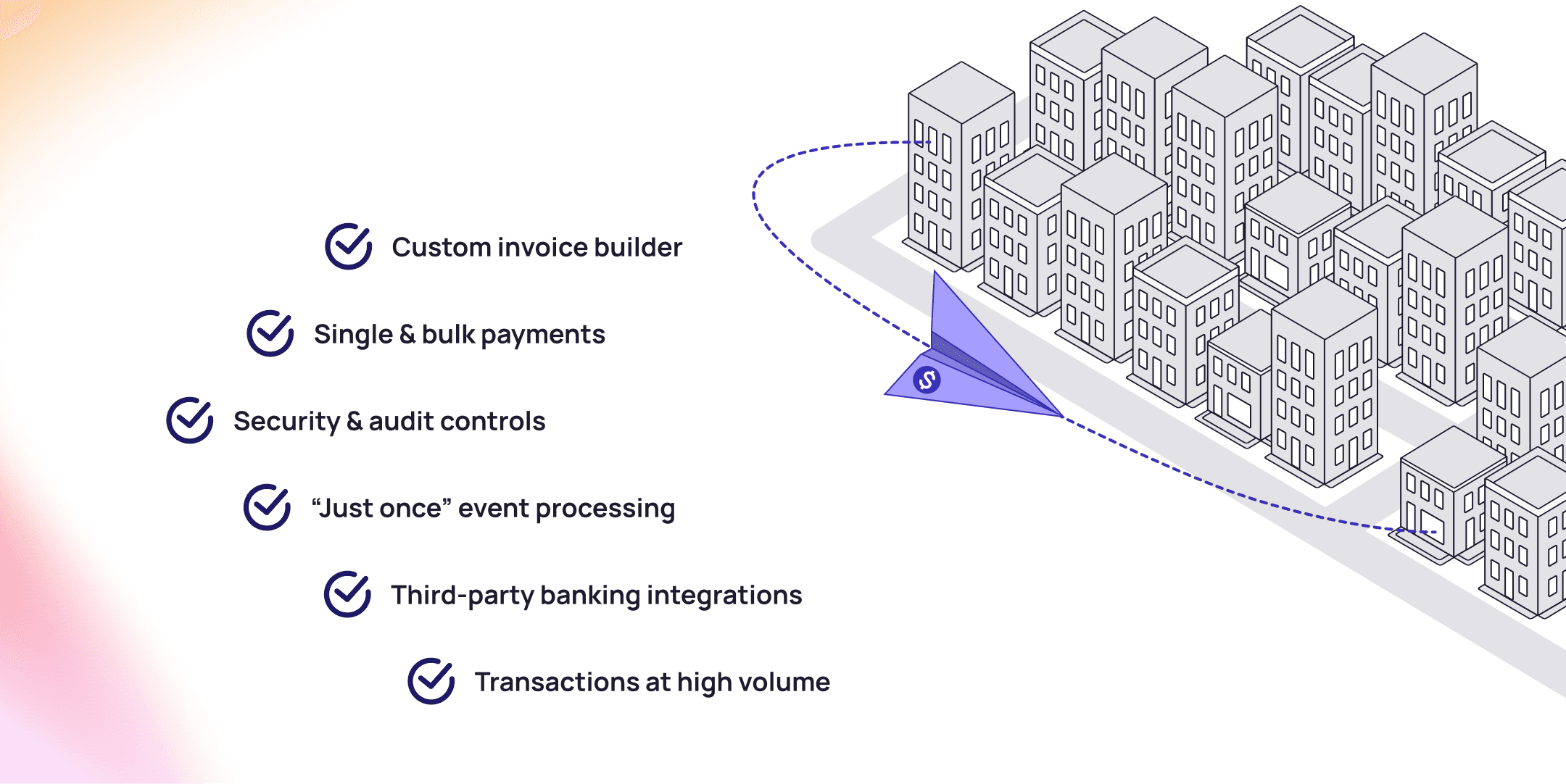

Featuring elegant UX and branding, integration that could handle a bevy of payment methods, and advanced invoice and company team management, Fastwire was built to schedule in less than 8 months. It featured the ability to set up invoice templates with customised templates, work with banks and credit cards, and manage access privileges and sign-off workflows for the teams. It also had a lot of features unique to the B2B space: handling the importing of invoices in bulk, audit logs for team member activities on the platform and an enterprise-ready security-first web application architecture.

Core Features

Single and Bulk Invoicing

The invoicing process was derived from researching popular payment platforms such as Xendit, Quickbooks, and Stripe. Given that we were aware that this was a drastic shift from what they were used to, through competitive research, we were able to identify conventional UX patterns found in these platforms and we applied these concepts to their interface.

Payment Tracking

It was very important for finance teams to track payments, and so a tracking system was included to inform the finance partner if the client has already paid. There were other statuses also included, as it was very common for their customers to dispute certain charges. This helps finance teams benchmark line items faster.

Partial Payments

This allows customers to pay only specific line items in their invoices.

Online Payment Options

Through the new platform, their clients would now be able to pay online, without having to go through the hassle of paying through a bank teller. This method also allows the finance partners to track the source of the deposit, thereby reducing the friction in identifying where the payment was processed.

Fastwire Team’s VisionFastwire is an innovative SaaS solution that automates and digitizes end-to-end financial workflows.”

About the Authors

White Widget Team is known for delivering holistic, award-winning software solutions across diverse sectors such as transport, healthcare, and media, emphasizing a comprehensive approach to digital innovation, since the company was founded in 2012.

Case Study•

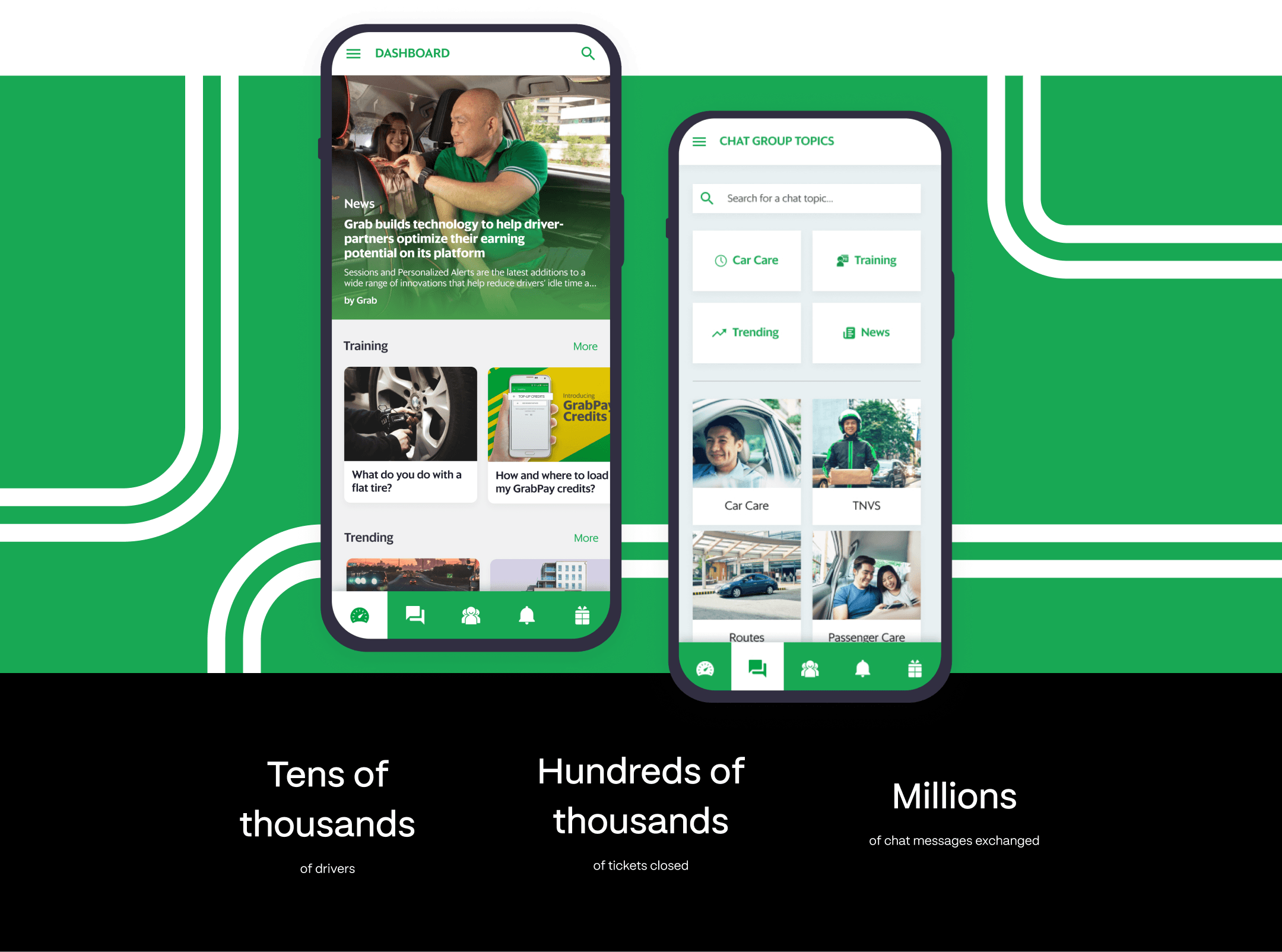

Chat-meets-helpdesk connecting thousands of Grab drivers

We developed Grab’s Community platform, consisting of a moderator web app connected to Android & iOS chat-meets-helpdesk apps, for Grab drivers. It was used to manage driver fleets for Asia’s premiere unicorn tech startup, with tens of thousands of users & tickets managed in realtime

Case Study•

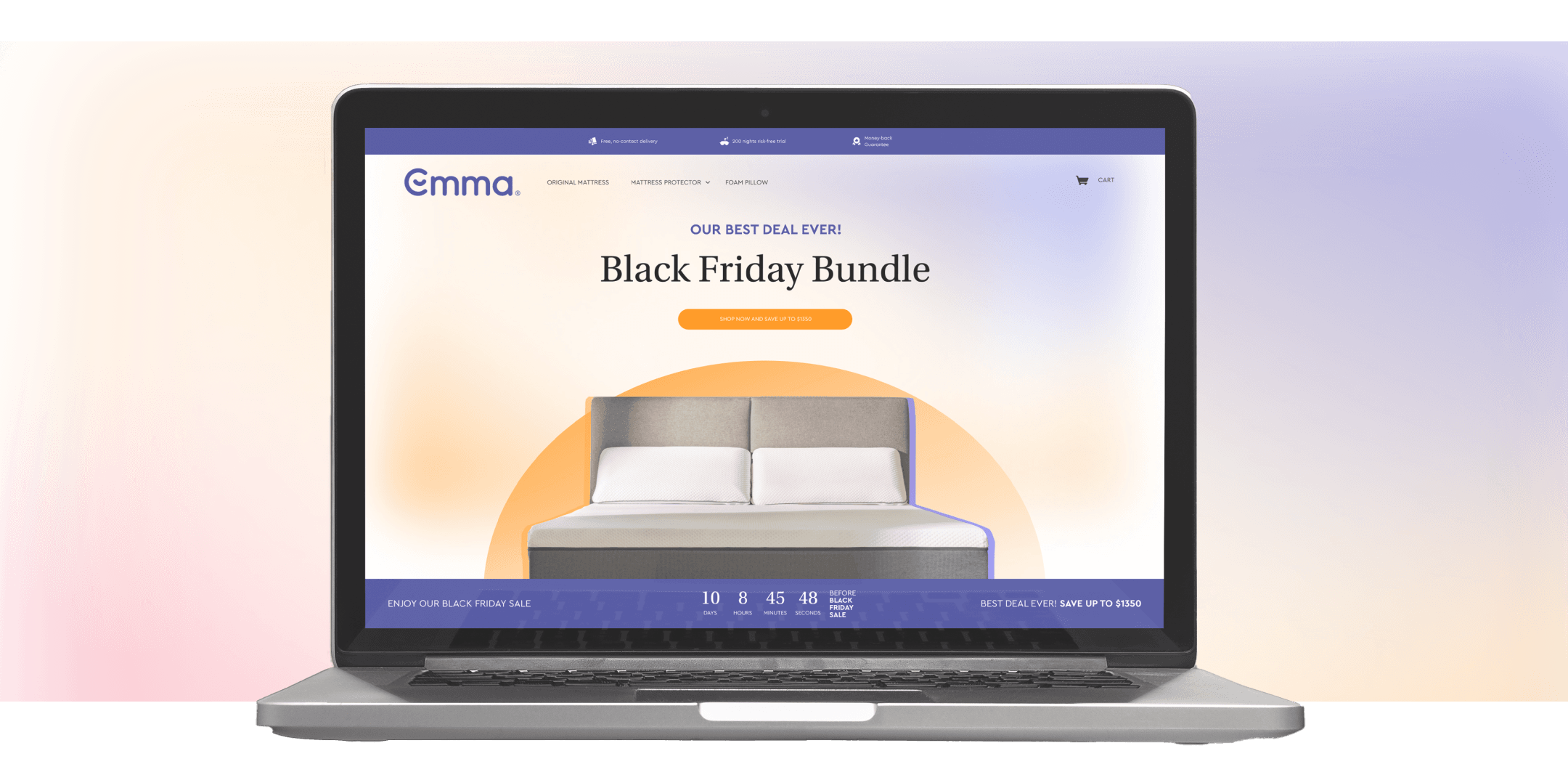

Dreamy online store for Europe’s #1 Sleep Brand

We developed an e-commerce website for Emma Sleep, Europe’s #1 sleep brand, and helped them exceed their US Black Friday sales records