Case Study

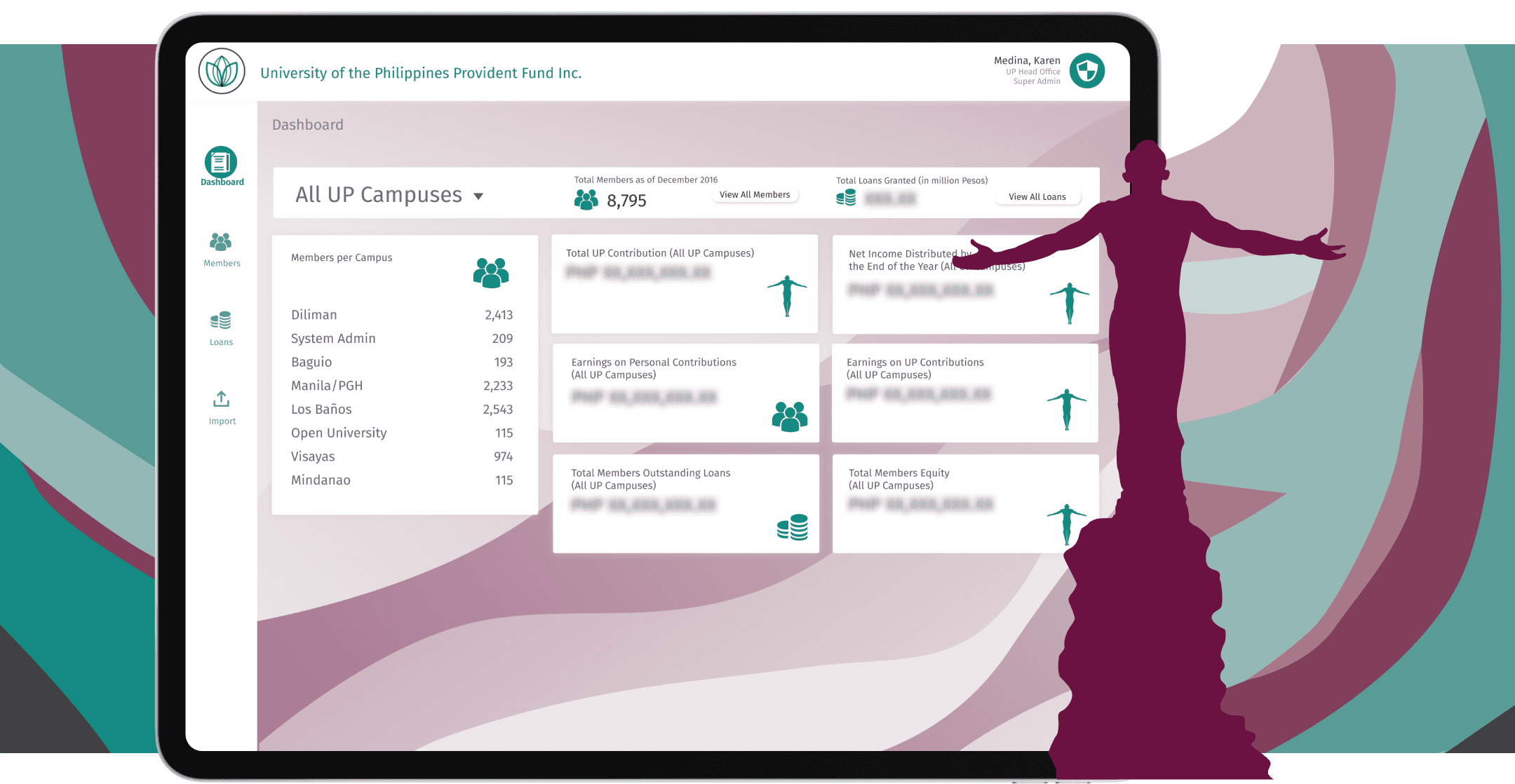

Financial equity tracker for 10,000+ employees of the Philippines’ largest university network

Last Updated on October 7, 2025

by White Widget Team

We made software for thousands of employees, who in turn, educated millions. Where do you want to build impact?

UP Provident Fund (UPPF) is a voluntary retirement savings program established by the University of the Philippines (UP) for the benefit of its employees. Through the UPPF, UP employees are empowered to proactively invest in their future by contributing a portion of their earnings towards their retirement savings. This program provides a structured platform for employees to accumulate funds over the course of their careers, with the aim of securing a comfortable and financially independent retirement.

A Portal for All

Web App

Product Design

UX Research

Custom Development

Web Admin Backoffice

Web User App

Cybersecurity

Infrastructure

DevOps

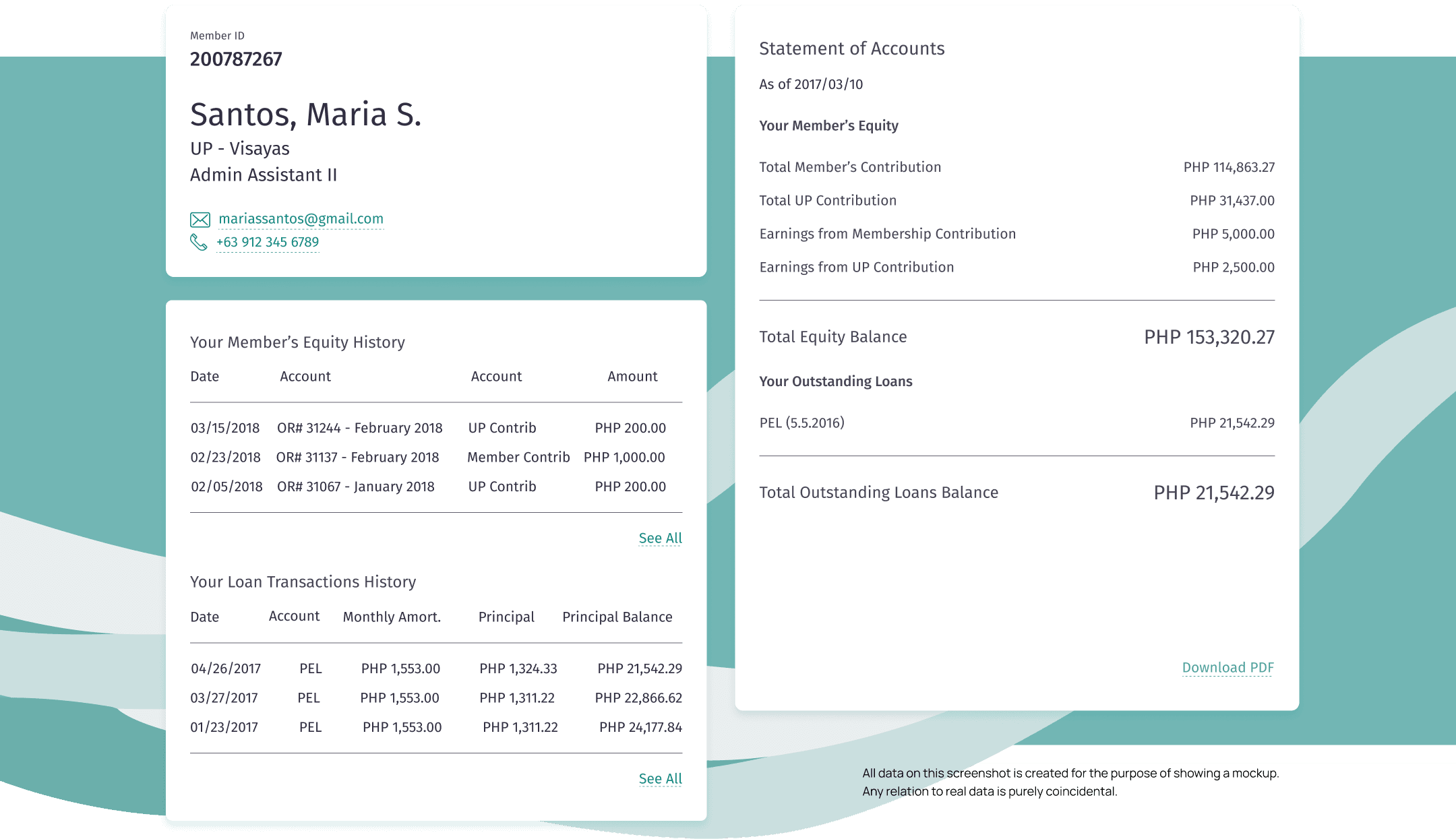

To streamline and enhance the accessibility of services for its members, the UP Provident Fund Incorporated (UPPFI) can develop a comprehensive online portal that offers a user-friendly interface for members to conveniently check the status of their contributions, loans, and equity. Here's an outline of the features and functionalities that the portal could include: Member Dashboard Upon logging in, members are greeted with a personalized dashboard displaying an overview of their account, including current contribution balance, outstanding loans, and equity status. Contribution Status Members can view a detailed breakdown of their contribution history, including monthly contributions, total accumulated balance, and any additional voluntary deposits made. They can also track any changes or updates to their contribution rates. Loan Management The portal allows members to monitor the status of their loan applications, view outstanding loan balances, repayment schedules, and any accrued interest. Members can also access loan calculators to estimate loan amounts, terms, and monthly repayments. Equity Information Members can access information regarding their equity shares in the UPPFI, including the current value of their shares, dividends received, and any changes in equity allocation.

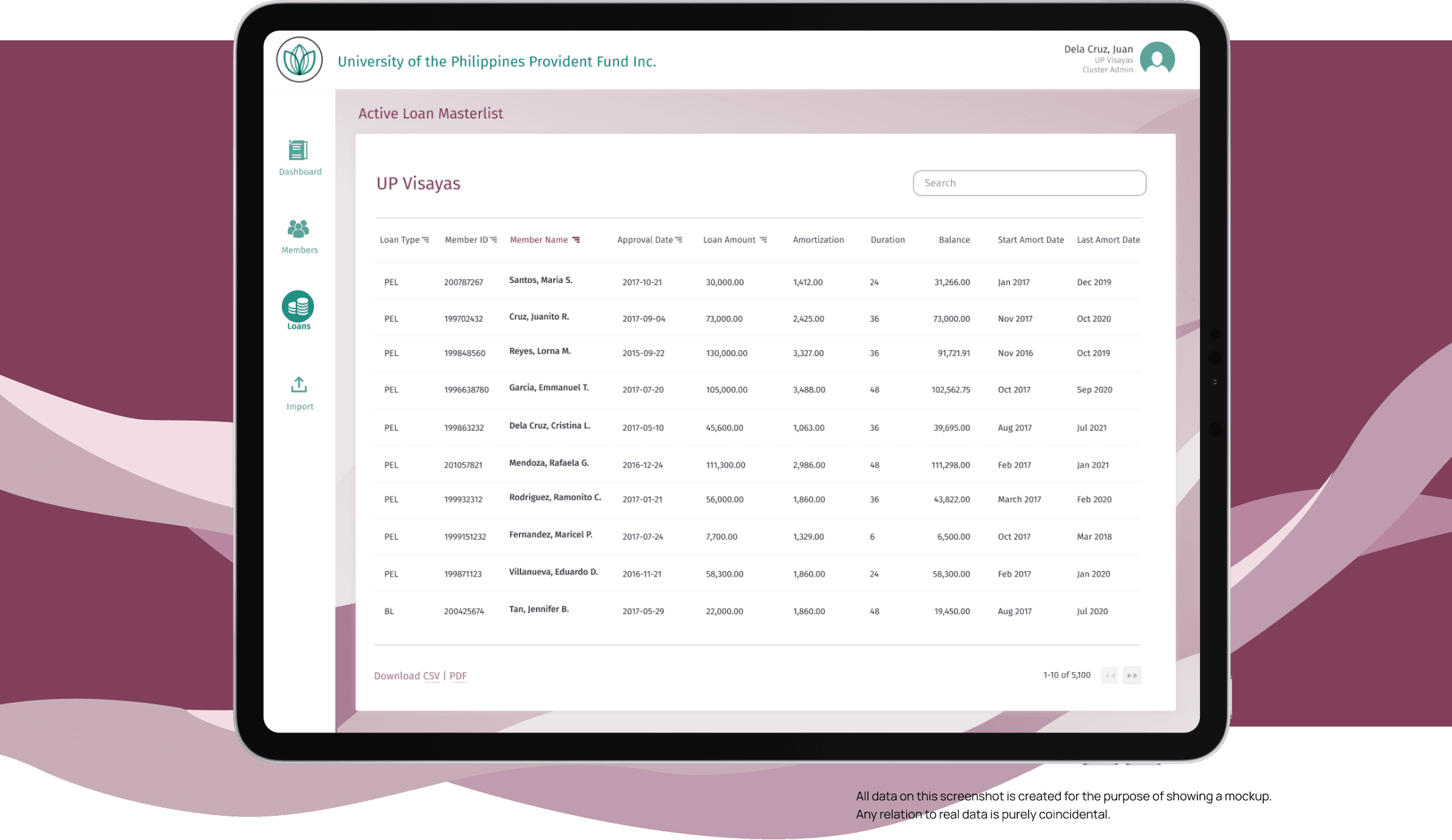

Varying Admin Views

The UP Provident Fund Incorporated (UPPFI) has an administrative system with different access levels for accountants:

Superadmin

This person has full control over the entire system, seeing and managing everything across all campuses and clusters.

Cluster Accountants

They manage finances for specific clusters of campuses. They can only access data related to their assigned clusters. All accountants can generate reports and analyze financial data to make informed decisions. The system also has security measures to keep data safe. This setup ensures efficient management and accountability throughout the UPPFI.

Boosting Growth

In the four years since its launch, the UP Provident Fund (UPPF) has seen impressive growth. Its membership has expanded to 10,000, and its assets have soared from Php 1 billion to Php 3.2 billion. This growth has been fueled by the user-friendly member portal, which has made it easier for members to check their contributions and manage their loans. This portal has enhanced member satisfaction and trust in the UPPF, demonstrating its commitment to providing accessible and efficient services to its growing membership.

About the Authors

White Widget Team is known for delivering holistic, award-winning software solutions across diverse sectors such as transport, healthcare, and media, emphasizing a comprehensive approach to digital innovation, since the company was founded in 2012.

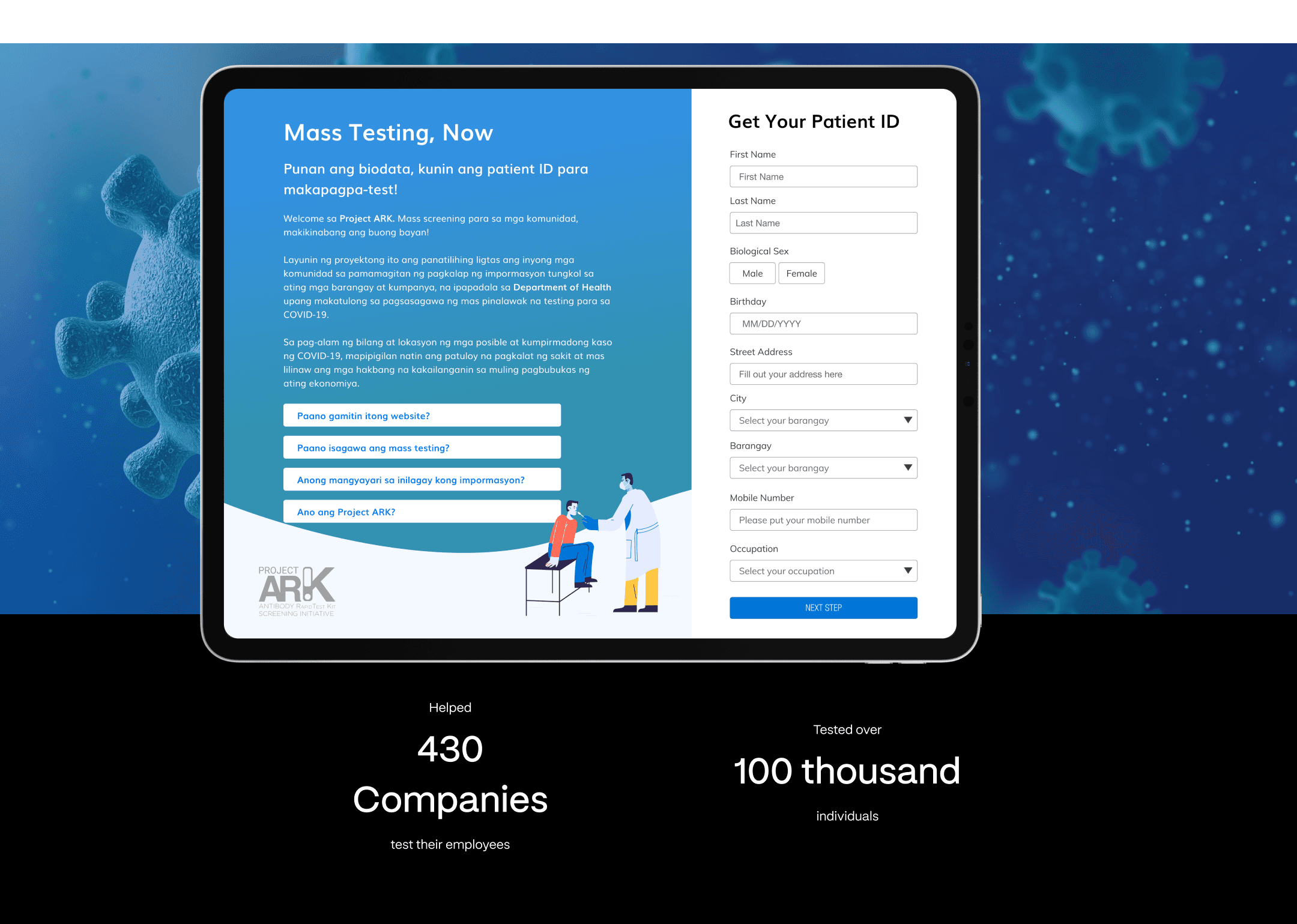

Case Study•

Bringing people back to work: Triumphing over the COVID-19 Pandemic through mass testing

White Widget donated its time to build a mass testing platform which tested tens of thousands of employees belonging to 200 companies, in order to help alleviate the economic crisis caused by COVID.

Article•

Overcoming LLM Hallucinations with Trustworthiness Scores

In today's AI-driven world, businesses increasingly rely on large language models (LLMs) to scale operations. However, the risk of AI generating inaccurate or misleading information can also scale, posing significant challenges. This article delves into trustworthiness scoring, exploring its key dimensions and techniques. Through real-world examples, we show how trustworthiness scores can help mitigate LLM hallucinations, making your AI solutions more reliable and accurate. Discover how to enhance the trustworthiness of your AI implementations in our comprehensive guide, with a nod to the work done by MIT's CleanLabs.