From Cost Sink to Growth Engine: Modernizing Fintech Systems

Last Updated on September 16, 2025

by White Widget Team

White Widget Team

Modernize with confidence

For decades, financial services like traditional banks have shaped the flow of commerce across global markets. But its most critical systems rely on a technology born over half a century ago. COBOL-powered core infrastructure once provided the stability that financial institutions needed. In today’s fast-moving, digital world, what worked in the past doesn’t guarantee success in the future. Modernization isn’t optional. The only questions are when and how you’ll do it.

The Business Case for Modernization

Legacy isn’t just old - it’s risky

The matter isn’t simply patching outdated infrastructure. Even before recent technologies like AI emerged, architectures based on Common Business-Oriented Language (or COBOL) have had difficulty adopting newer technologies developed by rising fintech. Observably, the enduring reliance on COBOL among traditional institutions is rooted in its long-standing reputation for stability and reliability. Decades of investment in its maintenance and integration have made it a core component of many mission-critical systems. However, it poses an increasing strategic risk. The pool of developers proficient in the language is steadily shrinking. Even the most forward-thinking banks hit a wall when modern tools meet the rigidity of legacy systems. Integration gets messy — and expensive. As the digital landscape evolves, it costs companies stuck with legacy systems a lot - we’re talking about money in the millions. It’s not just the costs for the run time. There’s also a lot of money lost in chances to innovate, in staying competitive and in securing customers. For example, they miss out on leveraging AI capabilities like automated customer profiling that instantly adapts to user behavior and preferences. Customers now expect systems that can handle instant payments, detect fraud in real-time, and offer highly personalized services. While most customers don’t know what legacy architecture is, they certainly feel its effects:

- Balances that take hours (or days) to update

- Weekend downtime that interrupts digital services

- Account opening processes that span multiple apps or in-person steps

- Payments that fail during peak demand

These are often symptoms of a deeper, systemic issue: accumulated technical debt.

Source from: Bank Automation News

Movement and Influences in Fintech

Fintechs have redefined what customers now expect from financial services. They’ve introduced agile development models, digital-first experiences, and innovative use of data. This in turn has accelerated what customers expect from the general financial service providers. Their impact has pushed traditional banks to rethink how they work—with customers, with technology partners, and with regulators. In many cases, fintechs and established players are now working together to deliver faster, more scalable, and more inclusive financial services.

The Growing Costs of Technical Debt

Recent regulatory pushes Back in 2018, the EU rolled out the Revised Payment Services Directive (PSD2) to level the playing field between banks and fintechs. The idea was to open up banking, boost security, better protect consumers, and speed up the EU’s shift toward a fully digital economy. It was both a response to technological change and a proactive effort to future-proof the European financial ecosystem. It was a catalyst for movement in modernizing legacy infrastructure, especially in areas like:

- API adoption

- Cybersecurity

- Real-time processing

- Scalable cloud infrastructure

- Customer identity and access management (CIAM)

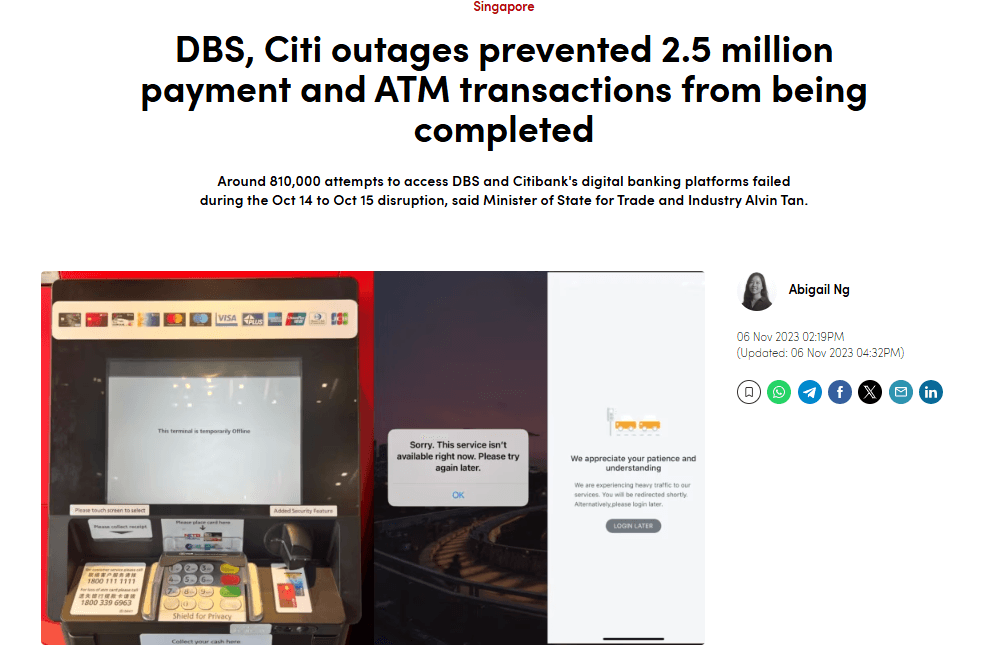

While PSD2 is an EU regulation, it’s become a benchmark for where the world of fintech is heading. Its impact is observable in the ASEAN region where similar initiatives are being launched. In Southeast Asia, regulators are taking similar steps to drive digital innovation. Singapore’s Monetary Authority (MAS) launched APIX—a global, open platform designed to help banks and fintechs work together and build new solutions. Over in Indonesia, the Financial Services Authority (OJK) rolled out its Blueprint for Digital Banking Transformation, highlighting the importance of building secure, efficient digital banking ecosystems. PSD2 set a new bar for security, openness, and customer-centric design. It highlighted just how far apart modern, API-ready systems are from the outdated tech still running inside many traditional banks. Institutions falling behind these emerging standards are finding themselves ever more burdened by technical debts. With digital-first competitors rolling out updates every week and focusing on smooth, seamless customer experiences, the flaws in traditional banks’ legacy systems have become too big to ignore. That was exactly the case in 2023, when a major bank in Singapore faced repeated service outages—traced back to aging infrastructure and patchy governance.The fallout: regulatory penalties, damaged public trust, and a mandated transformation effort.

HSBC’s 2025 outage was linked to its digital platforms failing to integrate smoothly with legacy backend systems. The result? Customers couldn’t access online or mobile banking during peak hours.

Source from: Global Data

Roadmaps Toward Modernization

No one-size-fits-all model

Some institutions choose to refactor parts of their architecture; others opt to replatform or rebuild from the ground up. Even the rigidity of COBOL systems can be met with careful maneuvering like with modular replacements. The suitable path is one that’s customized, depending on existing infrastructure, business priorities, and risk tolerance. Though, one truth cuts across: the longer you wait, the more costly and complex modernization becomes.

GartnerBy 2025, 90% of current enterprise applications will still be in use, but most will lack the support for innovation. ”

Start with what matters most

Successful transformation doesn’t require replacing everything at once. To kick off their modernization journey, many banks are moving to cloud-native architectures. It helps them scale more easily, cut down on operational complexity, and roll out new features faster and more securely. Others are going the API-first route, using it to connect legacy systems with modern services. This makes it easier to plug in fintech partners, enable real-time decisions, and stay responsive to what customers want. Systems built for high availability and real-time responsiveness — like this helpdesk integration — show what modern fintech architecture can deliver, all without the weak spots that come with legacy tech. Rather than a single overhaul, modernization is often a phased strategy: updating what matters most, when it matters most. Whether it’s meeting compliance requirements like PSD2 or improving the user experience, the goal is to build a system that’s not just keeping up with today’s needs—but ready to support what comes next.

Remove the barriers that slow down progress

At a minimum, companies can (and should!) modernize their customer-facing frontend, aligning it with contemporary digital standards. This approach allows institutions to deliver a significantly improved customer experience without overhauling their backend systems right away. Why not just modernize everything at once? In short: the risks and costs are prohibitive. A full-scale overhaul often demands extended downtime—something most financial institutions and their clients cannot tolerate. Moreover, backend systems are often deeply embedded in an institution’s core operations, supporting critical functions like transaction processing, risk management, and compliance. These systems have usually grown over decades, packed with layers of custom code and tangled dependencies. This means that even the smallest of changes could be complicated and risky. A misstep can disrupt essential services or compromise data integrity.

In contrast, frontends are more modular and less tightly coupled with core systems, making them faster and less risky to update. Starting with the frontend lets organizations show quick wins, boost customer satisfaction, and build internal support. This gives institutions time to carefully plan the trickier backend overhaul.

Did you know?

The Strangler Fig Pattern is inspired by a tree that gradually envelops and replaces its host. In tech, it’s a low-risk way to modernize legacy systems by surrounding them with modern services. Over time, this strategy replaces outdated components one step at a time without the disruption of a full rebuild.

Modernization is often a phased strategy: updating what matters most, when it matters most. Whether driven by compliance demands like PSD2 or the need for better user experiences, it’s about building a system that doesn’t just chase present trends but ultimately supports future innovations.

The Modernization Checklist

Now, a structured, outcome-driven approach is critical to successful modernization. Use this checklist to guide decision-making, mitigate risk, and align transformation with your business goals.

1. Understand Your Starting Point

- Conduct a comprehensive audit of legacy systems and interdependencies

- Identify business-critical bottlenecks and operational risks

- Assess technical debt and quantify its impact on agility, cost, and compliance

Forward-looking fintechs are redesigning for explainability and governance from the ground up. This lays the groundwork for trustworthy, enterprise-grade AI built to meet strict regulations and earn customer confidence.

2. Set Clear Business and Technical Goals

- Define the outcomes modernization should achieve (e.g., enhanced customer experience, faster product delivery)

- Establish measurable technical objectives (e.g., reduced latency, improved uptime, greater scalability)

3. Choose the Right Strategy per System

- Retain: Rehost or replatform systems with stable functionality and low change pressure

- Rebuild: Rearchitect or rewrite components that hinder flexibility or innovation

- Retire: Decommission outdated or redundant systems that no longer deliver value

4. Modernize Safely and Incrementally

- Apply the Strangler Fig pattern to phase out legacy systems with minimal disruption

- Introduce continuous integration, delivery, and automated testing pipelines

- Embed security and compliance protocols across every modernization layer

Modernization often includes building scalable B2B SaaS platforms tailored to financial institutions. A strategy explored in this case study addresses legacy systems through modular design and cloud-native infrastructure.

5. Embrace a Modern Technology Stack

- Transition to cloud-native infrastructure for scalability and resilience

- Adopt microservices architecture with API-first integration to boost agility

- Implement full-stack observability and DevOps automation to streamline operations

While backend transformation can take years, frontend updates yield immediate user value. A refreshed, frictionless interface can dramatically boost user trust and retention during phased modernization. For banks under pressure to stay compliant and competitive, the cost of waiting is outweighing the cost of change. A deliberate, phased approach won’t fix everything overnight—but it’s how real progress begins.

About the Authors

White Widget Team is known for delivering holistic, award-winning software solutions across diverse sectors such as transport, healthcare, and media, emphasizing a comprehensive approach to digital innovation, since the company was founded in 2012.

Article•

Scraped by AI? The Signs You’re Being Harvested—and What to Do

Bots now train AI on your content. Learn the warning signs and a layer defense playbook, that you can use.

Article•

Unseen, Unfair, Unbeatable—8 Industries Using Knowledge Graphs to Rewrite the Rules of Competition

Discover how industries like finance, healthcare, and retail are leveraging knowledge graphs to unify enterprise data, streamline decisions, and enable AI.