Build Insurance Platforms That Adapt to Tomorrow

Deliver InsurTech systems that combine efficiency and innovation.

Insurance Technology Development

Build systems for claims processing, underwriting, and policy management.

Underwriting, Modernized

We digitize insurance workflows from quote to claim with clean data and clear handoffs.

Rating engines, policy admin, FNOL, and fraud checks reduce cycle time and leakage.

For Insurers and Innovators

We support established carriers and InsurTech startups alike.

Modernize core systems.

Launch MVPs quickly and securely.

Digital platforms for client management.

Tools for complex risk modeling.

Insurance Software Solutions

Our platforms automate and connect insurance operations.

End-to-end policy lifecycle tools.

Faster, error-free claims processing.

AI-driven risk analysis and scoring.

Self-service experiences for policyholders.

Insights into risk and performance.

Our InsurTech Development Process

We blend compliance expertise with agile execution.

Align systems with legal standards.

Build secure, scalable frameworks.

Deliver modules iteratively with testing.

Deploy, monitor, and refine.

AI That Powers Insurance Platforms

We use AI to assess risk, automate claims, and personalize policies.

Policy Data

Coverage details and history.

Claims Records

Past and current claims.

Customer Data

Demographics and risk factors.

Underwriting Models

Historical risk patterns.

Fraud Indicators

Red flags from past activity.

Risk Scoring

Fraud Detection

Prediction Models

Classification

Recommendations

Smart Underwriting Tools

Faster, AI-assisted decisions.

Fraud Detection Alerts

Stop suspicious claims.

Automated Claims Workflows

Streamline processing.

Personalized Policies

Tailored coverage for customers.

Risk Dashboards

Insights for insurers and reinsurers.

Deliver InsurTech systems that combine efficiency and innovation.

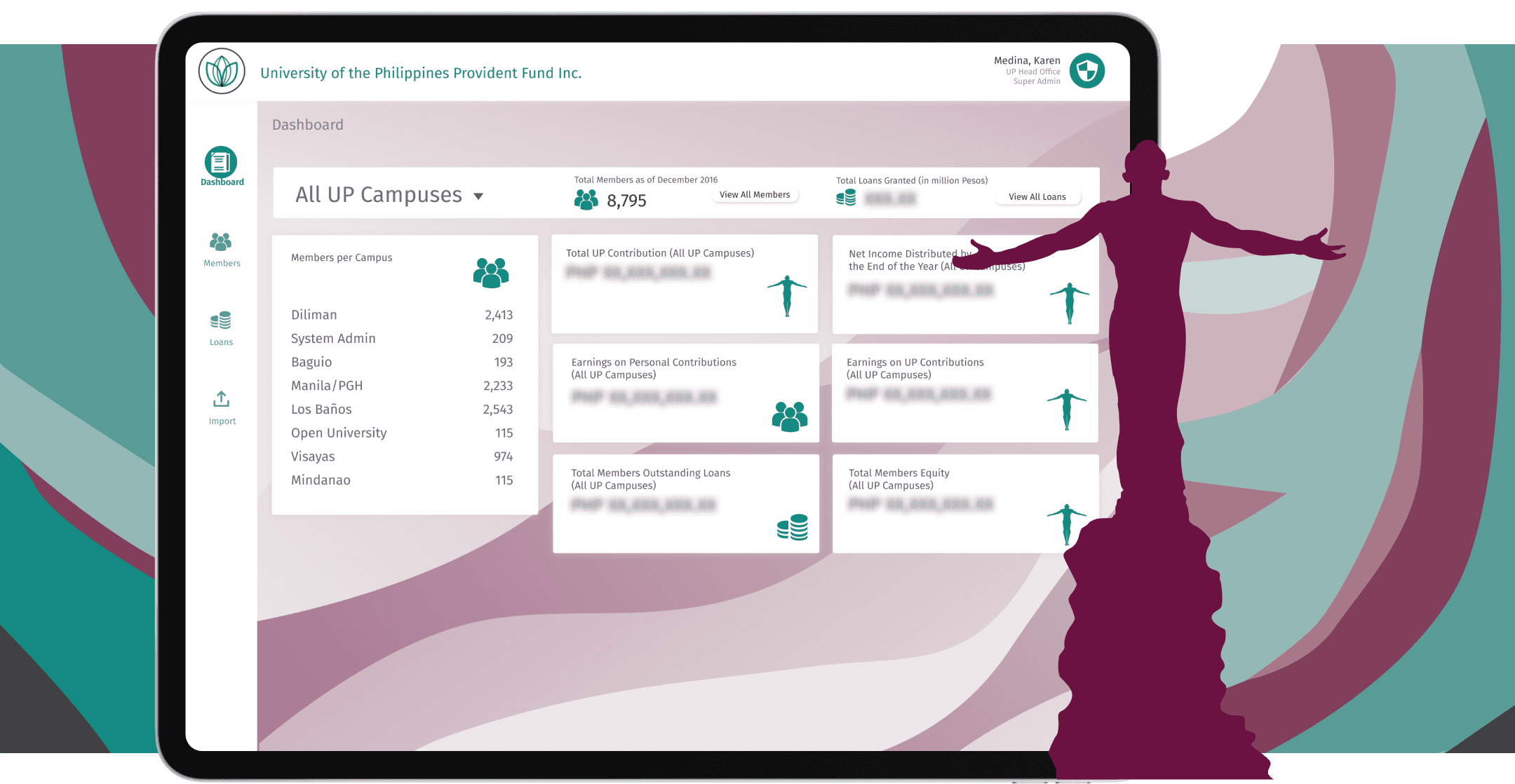

Case Study•

We built a financial equity tracker for 10,000+ employees across all UP campuses, serving the Philippine's largest university network

Article•

Explore how Digital Twins are transforming smart transportation through predictive maintenance, AI integration, and vendor-neutral system design; powered by semantic modeling and knowledge graphs.